Greater Toronto Area (GTA) housing market conditions tightened in March 2023. Sales accounted for an increased share of listings in comparison to March 2022, suggesting that competition between buyers is on the rise. The average sale price was above the average list price for the first time since May 2022.

“As we moved through the first quarter, Toronto Regional Real Estate Board (TRREB) Members were increasingly reporting that competition between buyers was heating up in many GTA neighbourhoods. The most recent statistics bear this out,” said TRREB President Paul Baron. “Recent consumer polling also suggests that demand for ownership housing will continue to recover this year. Look for first-time buyers to lead this recovery, as high average rents move more closely in line with the cost of ownership.”

GTA REALTORS® reported 6,896 sales through TRREB’s MLS® System in March 2023 – down 36.5 per cent compared to March 2022. On a month-over-month basis, actual and seasonally adjusted sales were up. New listings were also down on a year-over-year basis, but by a much greater annual rate. This points to tighter market conditions compared to last year.

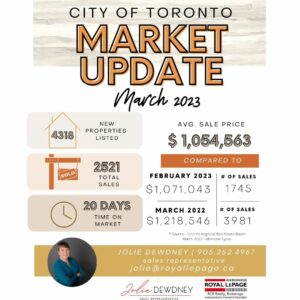

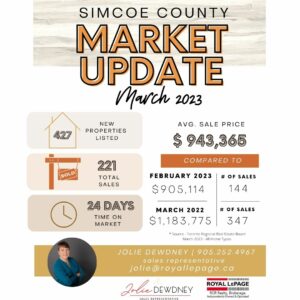

The average sales price in the City of Toronto dropped slightly by 1.54% over the February figure and showed a 13.46% decrease compared to March 2022. In Simcoe County, the average sales price increased by 4.23% over last month but showed a decrease of 20.31% compared to March of last year. York Region’s average sales price showed an increase of 3.21% since February but has decreased 11.31% compared to March 2022. More detailed information on each of these areas can be found in the charts below.

“Lower inflation and greater uncertainty in financial markets has resulted in medium-term bond yields to trend lower. This has and will continue to result in lower fixed rate borrowing costs this year. Lower borrowing costs will help from an affordability perspective, especially as tighter market conditions exert upward pressure on selling prices in the second half of 2023,” said TRREB Chief Market Analyst Jason Mercer.

The MLS® Home Price Index composite benchmark was down by 16.2 per cent on a year-over-year basis, but up month-over-month on both an actual and seasonally adjusted basis. Similarly, the average selling price was down by 14.6 per cent year-over-year to $1,108,606. The average selling price was up month-over-month on an actual and seasonally adjusted basis.

“As population growth continues at a record pace on the back of immigration, first-time buying intentions will remain strong. Because the number of homes for sale is expected to remain low, it will also be important to have substantial rental supply available. Unfortunately, this is not something we have at the present time. We need to see a policy focus on bringing more purpose-built rental units on line over the next number of years,” said TRREB CEO John DiMichele.

If you have questions about the real estate market, or are thinking about buying or selling and are not sure where to start, please reach out! I would love to help!

*Source – Toronto Regional Real Estate Board, March 2023