As we moved from 2022 into 2023, the Greater Toronto Area (GTA) housing market unfolded as expected. The number of January sales and the overall average selling price were similar to December 2022. On a year-over-year basis, both sales and prices were down markedly, continuing to highlight the impact of higher borrowing costs on affordability over the last year.

“Home sales and selling prices appear to have found some support in recent months. This coupled with the Bank of Canada announcement that interest rate hikes are likely on hold for the foreseeable future will prompt some buyers to move off the sidelines in the coming months. Record population growth and tight labour market conditions will continue to support housing demand moving forward,” said Toronto Regional Real Estate Board (TRREB) President Paul Baron.

GTA REALTORS® reported 3,100 sales through TRREB’s MLS® System in January 2023 – in line with the December 2022 result of 3,110, but down 44.6 per cent from January 2022. The average selling price for January 2023 at $1,038,668 was slightly lower than the December 2022 result and down by 16.4 per cent compared to the January 2022 average price reported before the onset of Bank of Canada interest rate hikes. The MLS® Home Price Index (HPI) Composite Benchmark was in line with the December result, but down by 14.2 per cent compared to January 2022.

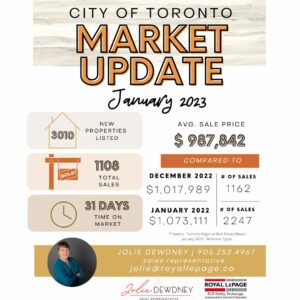

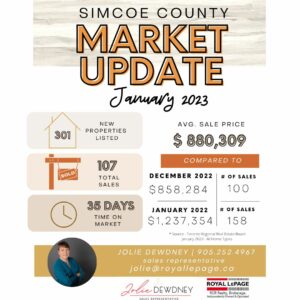

The average sales price in the City of Toronto dropped by 2.96% over the December figure and showed a 5.14% decrease compared to January 2022. In Simcoe County, the average sales price increased by 2.57% since last month but showed a whopping decrease of 30.64% compared to January of last year. York Region’s average sales price showed a slight increase of 1.42% since December but has decreased 16.58% compared to January 2022. More detailed information on each of these areas can be found in the charts below.

“Home prices declined over the past year as homebuyers sought to mitigate the impact of substantially higher borrowing costs. While short-term borrowing costs increased again in January, negotiated medium-term mortgage rates, like the five-year fixed rate, have actually started to trend lower compared to the end of last year. The expectation is that this trend will continue, further helping with affordability as we move through 2023,” said TRREB Chief Market Analyst Jason Mercer.

“All three levels of government have announced policies to enhance housing affordability over the long term, including many initiatives focused on increasing housing supply in the ownership and rental markets. Most recently, we were encouraged to see Toronto City Council support the Mayor’s 2023 Housing Action Plan as part of the City’s overall $2 billion commitment to housing initiatives,” said TRREB CEO John DiMichele.

If you have questions about the real estate market, or are thinking about buying or selling and are not sure where to start, please reach out! I would love to help!

*Source – Toronto Regional Real Estate Board, January 2023